“We are not just consultants; we are partners in your financial journey..”

-Handson Team

“Your Success, Our Priority: Discover how we transform financial planning into a roadmap for growth.”

CFO Services and Strategic Planning

Our CFO services provide comprehensive financial oversight, helping businesses align their financial strategies with long-term objectives. Whether you need assistance with financial reporting, budgeting, or cash flow management, we offer expert guidance. Our strategic planning focuses on data-driven decision-making, ensuring that every financial move is backed by a robust analysis of your company’s growth potential and market trends.

- Financial analysis and reporting.

- Budgeting and forecasting.

Cash flow management.

Long-term financial planning aligned with business goals.

Cost optimization and resource allocation.

Fund Raising (Debt & Equity)

We specialize in structuring both debt and equity fundraising strategies tailored to your business needs. We assess your financial situation and recommend the best course of action, guiding you through negotiations with potential investors or lenders to secure funding that fosters growth without compromising your operational integrity.

Structuring optimal debt and equity solutions.

Investor relationship management.

Preparing financial models and business plans.

Assisting with investor pitch decks and presentations.

Negotiation support with lenders and investors.

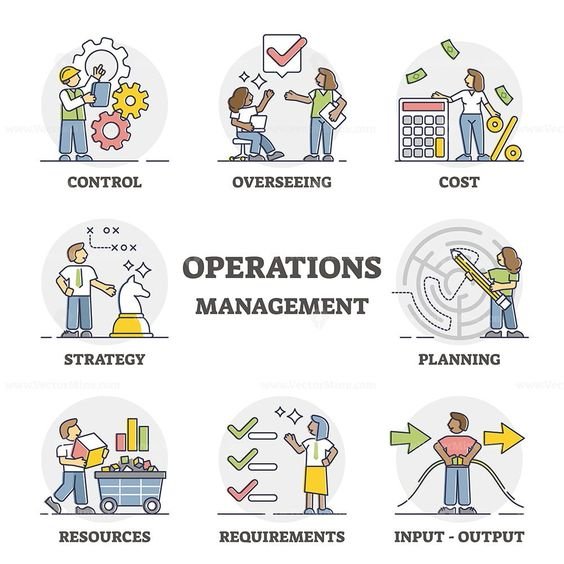

Business Operation Advisory

Our business operation advisory services help streamline processes, optimize workflows, and improve overall efficiency. We assess current operational bottlenecks, identify areas for improvement, and implement strategic changes that boost productivity while maintaining cost-efficiency.

- Operational efficiency assessment.

- Process optimization and automation.

- Resource management and workflow enhancement.

- Performance monitoring and KPIs.

- Strategic guidance for scaling operations.

Risk Management & Corporate Governance

Mitigate risks and ensure strong governance structures with our specialized risk management and corporate governance services. We help you establish robust risk control mechanisms while enhancing transparency and accountability within your organization, ensuring that both regulatory compliance and internal standards are met.

- Identifying financial and operational risks.

- Implementing risk mitigation strategies.

- Establishing internal control systems.

- Governance framework development.

- Regulatory compliance and audit preparation.

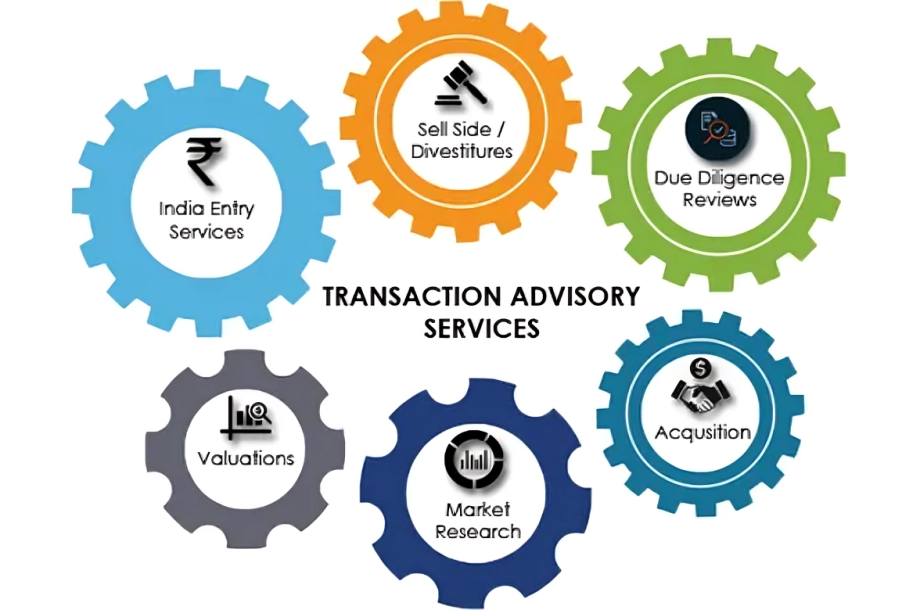

Transaction Advisory

Our transaction advisory services cover all aspects of mergers, acquisitions, and divestitures, ensuring you maximize value in any business deal. We provide expert advice at each stage of the transaction, from due diligence to valuation, to ensure smooth and successful outcomes.

- Financial due diligence.

- Business valuation and market analysis.

- Deal structuring and negotiations.

- Post-transaction integration support.

- Legal and regulatory guidance.

Best Reasons To Choose Our Services

Strategic Bridge

Connecting Businesses to Success

Tailored Solutions

Customized to Your Unique Needs

Navigational Support

Charting Your Financial Course and Managing Risks

Partner in Growth

Turning Challenges into Opportunities